Request your Consultation

Posted on December 14, 2022 in asset protection,probate,trust

Estate planning can be a difficult and complicated process. As you plan for the assets you have and what your wishes are, you want to make the best decisions to ensure that those wishes are carried out. You may also want to take steps to make the process easier for those who have been entrusted with taking care of them. However, as with any decision in life, there are always options that you should weigh to determine which route is best for you.

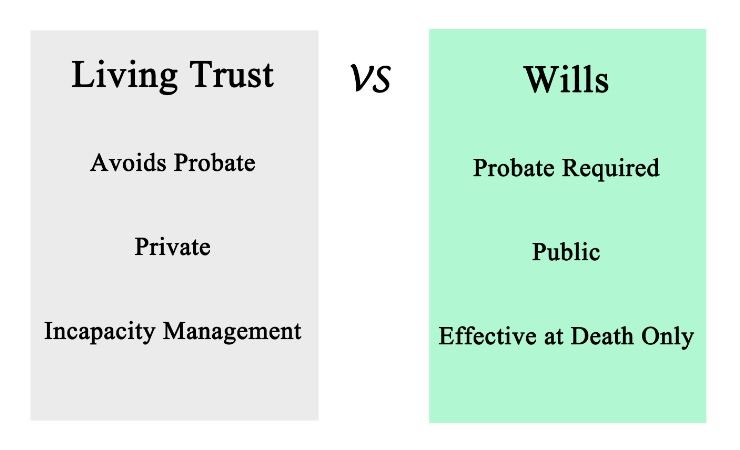

Both a will and a trust dictate how your assets will be divided. However, a will is effective immediately upon your death, whereas a trust can begin while you are still living.

A will is a document that designates heirs and beneficiaries as well as your decisions on matters that arise after your death. It will also designate an executor who is tasked with upholding the contents of the will. They are also granted certain authorities, such as creating a trust or appointing a trustee. Wills are required by law to be signed and witnessed, filed with a probate court, and carried out by a designated executor. Wills become a matter of public record, and the court where the will is filed has jurisdiction over any disputes.

A trust, on the other hand, is a document that manages the transfer of assets from a trustor to a trustee. The trustee is required to manage the trust under the obligations set forth in the document. While a will is effective upon death, a trust is effective at the time the assets are transferred, which, when occurring before death, is called a “living trust.” Trusts are designed to uphold the best interests of their beneficiaries.

Trusts are often used for those who wish to have a structured distribution of assets, such as when there are large sums of money, complex estates, or minor children involved. They allow the trustor to create timelines and conditions that must be met before assets are distributed.

There are several types of trusts that one can use for the distribution of their assets. These all serve different purposes. Types of trusts include:

One of the many benefits of a trust is that it does not have to go through the legal system, which in turn saves the beneficiaries money by avoiding court costs. A trust is often executed quicker than a will. Placing assets in a trust helps to maintain the privacy of the trust’s creator, as a will is a publicly available legal document. This privacy also protects the beneficiaries, so it is unknown what the trust provides for them. These same protections can be useful for those wishing to keep business or real estate transactions private.

The use of a trust as opposed to a will is entirely determined by the family and is often contingent on the assets in question. Often, individuals who have a greater amount of assets, wish to remain private, and who also wish to keep their accounts out of the eyes of the probate court should utilize a trust for their estate planning. Trusts can often be more expensive to set up. However, they can offer more options to individuals who wish to have greater protection and decision-making over the outcome of their assets. Unlike a will, a trust cannot be contested in court.

A: The answer to this is determined by the preferences in estate planning that an individual seeks. For those who want more privacy and control, a trust is the better option. Wills are less expensive and offer an easier process. However, they can also be contested in court and are a matter of public record.

A: There are four main disadvantages of a trust:

A: The main difference between a will and a trust is in the system it must go through. A will must go through the probate system both in setting it up and in executing it. This, in turn, makes its contents a matter of public record, including any beneficiaries and what they will inherit. Because they go through the probate system, they can also be challenged there.

A: The amount of additional paperwork and the accuracy of record keeping are the two most significant challenges that one will face when listing their home within their trust. When a home is listed in a trust, the trust itself becomes the owner of the home. That means it must be legally signed over to the trust. Any changes with the home or any movement of the home in or out of the trust must also be accounted for accurately, both for legal and tax reasons.

There are many options you can choose from when it comes to estate planning. While there are pros and cons to both, it is important that you understand all the options that you have to best protect your assets and provide for your heirs and beneficiaries. If you are ready to start your estate planning process, seek the help of knowledgeable estate planning attorneys who can help guide you through the process and answer any questions you may have. At Ken R. Ashworth & Associates, we can make a complicated process easy. Contact our offices today for more information.